4 Resource consumption of minerals and metals

Environmental impact of €100 billion in arms investments

[back to table of contents]

Inhalt

4.1 Shortages of critical and strategic raw materials

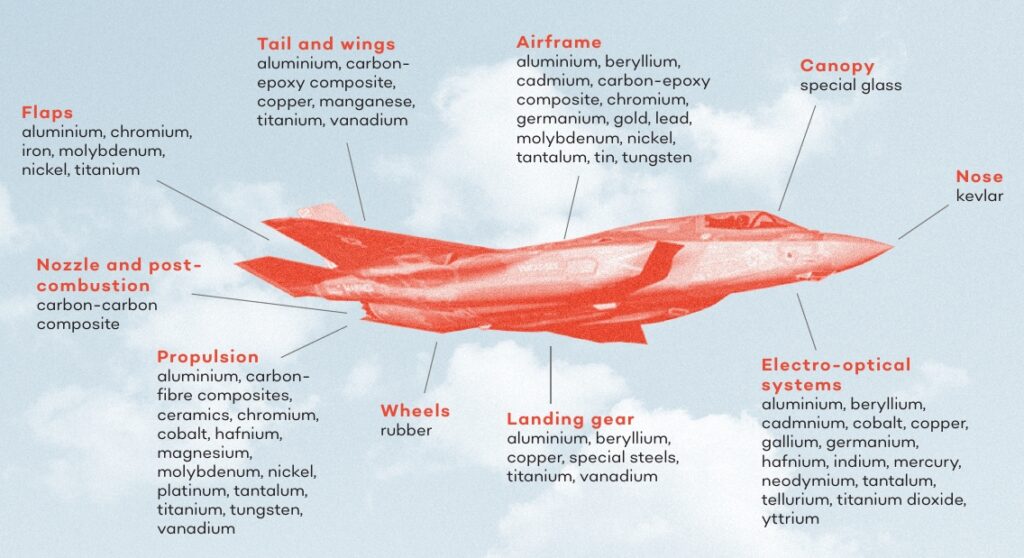

| Figure 4-1: Resource consumption of complex military equipment (Graphic: Kay Stephens, Source: Martial Mining Report 202011https://londonminingnetwork.org/project/martial-mining-2020/) The report published by the London Mining Network shows the interconnectedness of global extractivism, arms trade and warfare.The example of the F-35 fighter jet gives an idea of this problem (see also chapter 6.1). It consists of 300,000 individual parts and is assembled by 1,900 suppliers around the world. For the aircraft’s vertical stabiliser alone, 30 separate titanium parts are produced. More than 450 kg of rare earth metals must be provided for each F-35 fighter aircraft. An F125 class frigate („Baden-Württemberg“ class) requires about 1,920 kg of rare earth metals, according to unofficial figures, and a 212A class submarine more than 3,100 kg. 2https://esut.de/2019/03/fachbeitraege/politik-fachbeitraege/10982/strategische-rohstoffe-europas-rohstoffvorsorge-und-sicherheit-bedarf-der-neubewertung/ |

The post-fossil age means that metallic raw materials in particular will play a similar role in terms of extraction, access and transport routes as has been the case for oil and natural gas. This is problematic from both an ecological and an economic point of view, because the „extraction and use of metals has a wide range of environmentally harmful consequences, including toxic effects on humans and ecosystems“, as the OECD points out.3https://www.oecd.org/environment/waste/highlights-global-material-resources-outlook-to-2060.pdf

Ecological energy production, mainly using wind turbines, photovoltaics and battery-based storage systems, is only possible with new, complex technologies. These require not only classic metallic raw materials, but also to a large extent a number of rare earths. The name „rare“ is somewhat misleading, as the problem lies less in the lack of deposits than in the extremely costly and energy-intensive processing into raw products for industrial production.

If massive ecological problems are to be avoided, it is necessary to shape the transition to the new metal age from the outset in such a way that the often scarce and generally non-renewable mineral and metallic resources are used sparingly, with efficiency in production and sufficiency in use.

It follows that global coverage of future energy demand without fossil fuels is only possible with a drastic reduction in resource consumption. This would also increase the security of resource supply, which in many cases cannot be taken for granted today, either due to a lack of availability, or due to economic and/or political decisions, especially in the main supplier countries.

The main concerns about future supply capacities for selected materials are as follows.

For rare earths (dysprosium, neodymium and praseodymium), end users outside China will be dependent on China’s dominance in the global rare earth value chain (mining, oxides, metals, alloys and magnets) for the foreseeable future. The rising annual global demand for neodymium and dysprosium will significantly exceed annual global production by 2030.

The already tight nickel market will come under additional pressure from the ongoing shift in demand from the previous standard grade to high-purity Class I nickel (for cathodes, carbonyl nickel, powder, etc.).

For cobalt, the main concern for future security of supply is the high concentration of supply, as the DRC currently holds about 60% of global cobalt production and China over 60% of refined production.

The limited resources available have already been analysed at various levels. Some industrialised countries – including Germany – have national raw material strategies. The Federal Government’s raw materials strategy was presented as an update of the first version from 2010 at the beginning of 2020.

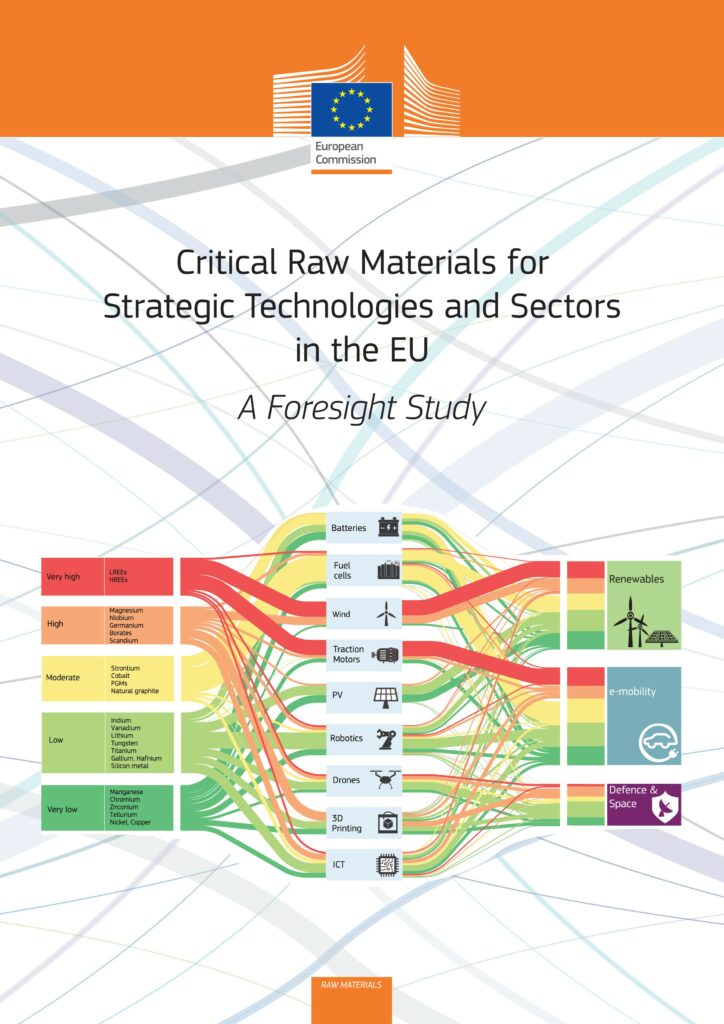

| Fig. 4-2: EU study on raw material competition (Source: EU)

An EU study published in 2020 openly names the competition between different sectors (renewables versus defence) for scarce raw materials. Of the raw materials already named in 2016, 22 are assessed as critical for the security of supply of the defence industry. This mainly concerns „base“ metals, but also a considerable number of rare earths. |

This was criticised in a joint statement by environmental associations (including BUND – German section of „Friends of the Earth“):

The German economy is the fifth largest consumer of metallic raw materials. The German government must finally take the climate consequences of this consumption into account and set binding measures. We need a raw materials turnaround that sets as a goal an absolute reduction in raw materials consumption. The answer to the question of security of supply can only lie in a consistent expansion of the circular economy.4https://www.presseportal.de/pm/7666/4492347

In other words, raw material and climate problems are not separate challenges, but two sides of the same coin. Without a reduction in resource consumption, the limitation of global warming will fail in the foreseeable future.

In addition to the national raw materials strategy, the EU Commission published a status report in 2016 entitled „Raw Materials in the European Defence Industry“.5https://setis.ec.europa.eu/system/files/2021-02/raw_materials_in_the_european_defence_industry.pdf.

It lists 39 raw materials in detail, including 6 rare earths. It is pointed out that China is the main producer of one third of these raw materials. In a recent study (EU, 2020), the dependence on China for raw materials for the defence industry is even given as 58%.6China is the major global producer of 58% of raw materials identified as important for defence applications“.

At the same time, however, the International Energy Agency (IEA) points to corresponding bottlenecks in raw materials for the global energy transition. A current report entitled „The Role of Critical Minerals in Clean Energy Transitions“ similarly addresses the threat of bottlenecks.7https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions In recent years, numerous geological investigations have therefore also taken place in Germany. However, these activities are limited by volatile world market prices, which make the development of raw material deposits a high financial risk.8 A detailed account of this from the point of view of the arms industry can be found in https://esut.de/2019/03/fachbeitraege/politik-fachbeitraege/10982/strategische-rohstoffe-europas-rohstoffvorsorge-und-sicherheit-bedarf-der-neubewertung/ .

4.2 Sectoral competition for raw materials

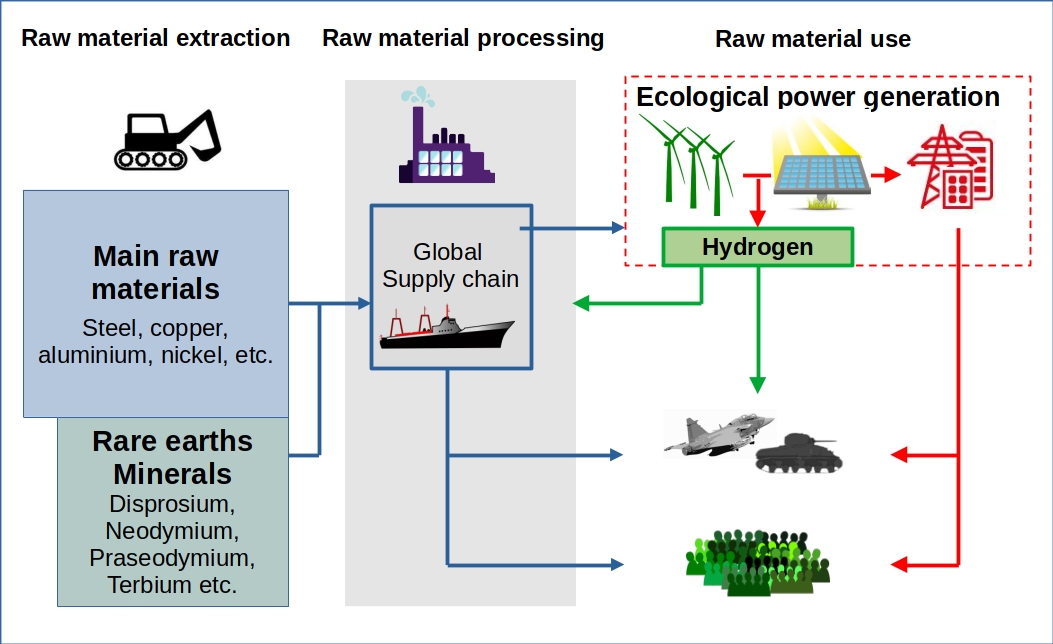

| Fig. 4-3: Raw materials and energy in the post-fossil age With the planned replacement of fossil raw materials and fuels, new dependencies arise through mainly metallic raw materials, which first have to be extracted and processed at great expense (see Fig. 4-4). This also results in new fragile and conflict-prone supply chains. |

Many critical materials have a range of applications in different industrial sectors, including renewable energy, e-mobility, defence, aerospace, and medical, chemical and petrochemical sectors, with digitalisation or information and communication technology (ICT) taking an increasingly relevant share in each. There will be increasing competition between all sectors for the same raw materials, processed materials and components. As an example, the International Energy Agency (IEA) explains that a typical electric car requires six times more minerals than a conventional car, and an onshore wind turbine nine times more minerals than a gas-fired power plant.9https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

This competition becomes particularly relevant when it comes to critical raw materials such as borates, gallium, indium, rare earths, cobalt, niobium and silicon metal. As mineral commodities are traded on international markets and other key countries such as the US and China rely on imports for some of them (e.g. niobium, chromium, tantalum), their availability could become even more critical for the EU.

Competition between world regions for access to raw materials will intensify as part of the transition to a low-carbon economy and based on new industrial strategies.

Of the emerging technologies, many are considered important for both European civil industry and the defence sector: High-performance batteries, fuel cells, photovoltaics, robotics, unmanned vehicles (drones), 3D printing and ICT. Although in some cases the military sector has different requirements for some of the properties of the materials used, but often made from the same raw materials, many military applications require the same materials that are used in the civilian sector (dual-use).

However, the complexity of the materials used often increases with the requirements. For example, special metal alloys are used for armoured vehicles, which are supposed to prevent approaching projectiles (from all sides, if possible) from causing relevant damage through hardness and rigidity. For fighter jets of the latest generation, a partially or completely existing stealth function against enemy radar is a main criterion. This requires not only special design measures, but also, similar to armoured vehicles, certain compositions of the construction material used.

One of the rare indications of the type of materials used is given by the data for the older Tornado fighter jet. According to these, the materials used for the airframe are light metals (71%), titanium (18%, mainly for the wing centre box), steel (6%) and other materials (5%).10https://de.wikipedia.org/wiki/Panavia_Tornado

At the Federal Environment Agency (UBA), a newly convened Resources Commission has been in place since May 2021. This commission examines key questions on resource conservation and the circular economy in Germany, Europe and the world. That the circular economy has a lot of potential is shown by the recycling rate for aluminium production of 50%, for crude steel of 45% and copper of 44%.11https://www.heise.de/tp/features/Auf-Metalle-aus-Russland-verzichten-7268213.html However, this only applies to a limited extent to military equipment.

On the recycling side, use is limited by the range of alloys, which makes separation into single-variety material fractions very costly when recycling. On the production side, it is often the case that military applications require a higher degree of purity and/or a special composition of alloys that can hardly be produced from recycled material. Therefore, the use of recycled materials is currently not considered for most military applications (which so far exclusively use primary materials).

4.3 Resource-economic effects of arms spending

It is obvious that the transformation to a CO2-free economy first of all requires a large ecological rucksack itself – after all, we are talking about the development of an area-wide infrastructure for energy, transport and many sectors of the economy. The EU has put environmental costs of the transformation due to the necessary use of certain raw materials at €38.9 billion – a considerable amount, but very small, only 3.7%, compared to the annual CO2 costs.12https://environment.ec.europa.eu/news/estimating-environmental-damage-key-resources-required-eu-low-carbon-transition-2022-10-05_en

|

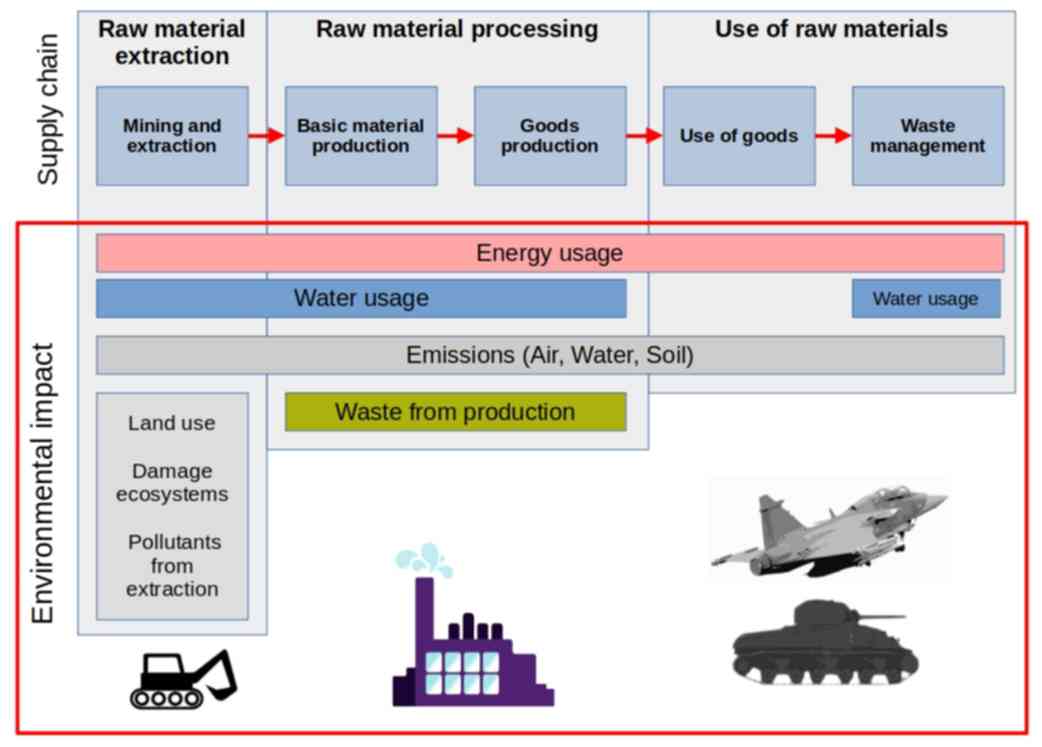

Fig. 4-4 Value chains and environmental impacts in the raw materials industry |

Previous assessments of the role of defence production on commodity demand assume that this military is relatively small in non-war times compared to civilian applications. Nevertheless, the current increase in military investment may affect the development of competing sectors such as ICT, green energy and e-mobility.

This is partly due to the volatility of commodity markets, which can react to even small increases in demand with significant price signals, and partly due to the scale of politically induced additional demand.

For example, the financial volume for the procurement of military equipment for the German Armed Forces amounted to almost € 10 billion in recent years. This contrasts with the planned expenditure of €100 billion, which is to flow exclusively into procurement.

Even assuming – technically unrealistic but economically optimal – that spending would be in equal tranches over the planned five years, thus minimising annual additional demand, it is still a tripling of annual spending on equipment. This is happening in an economic environment where other states are also increasing their defence spending, contributing to a global shortage.

This can lead to short-term crises if there is a shortage of supply that the markets cannot compensate for, e.g. due to quasi-monopolies on the supply side. In the case of such limited supply, the defence sector, for example, is unlikely to accept production stops and will most likely have priority in procuring the necessary raw materials. Civilian production and consumption will then have to take a back seat for security reasons, which may entail considerable economic and social costs.

A second mechanism has a more medium- to long-term effect. The defence industry is particularly dependent on a secure and long-term supply of mineral and metal raw materials (this applies in particular to the aerospace industry and military electronics).

This means that the military sector’s demand for raw materials is likely to be and remain much less elastic than that of the civilian sector, which can resort to „second best“ solutions here. This is likely to result in the military being able to acquire raw materials of specific qualities at a higher price than the competitive civilian market can afford.

And this in turn means that civilian innovations, e.g. in the fields of renewable energies, e-mobility and ICT, either cannot be realised at the planned (and ecologically urgently needed) speed or, if alternative materials are used, not with the planned effectiveness.

4.4 Raw materials in corporate reporting

The Federal Environment Agency (UBA) has published „Recommendations for Good Corporate Practice“, especially with regard to medium-sized companies. 13Sustainability Reporting: Recommendations for Good Corporate Practice https://www.4sustainability.de/wp-content/uploads/2021/06/BMU_Nachhaltigkeitsberichterstattung_Empfehlungen_Unternehmenspraxis_2008.pdf According to this, the report should contain at least the following key figures:

Energy consumption and climate protection: energy consumption, share of renewable energies, energy efficiency, emissions of greenhouse gases such as CO2 and other air pollutants;

Waste generation: Total amount of waste differentiated according to the most important types of waste or forms of treatment;

Water management: water consumption, wastewater volume and associated pollutant emissions, e.g. of heavy metals;

Consumption of raw materials: major material flows by type and quantity, material efficiency.

It is therefore necessary to examine the extent to which defence companies take these principles into account, which can only be done by way of example in the following.

The UBA guidelines are largely taken into account in water management. This can be found in great detail at MTU Aero Engines in the Sustainability Reports 2017 and 2021,14https://sustainability.mtu.de/de/ressourcenschutz/ but also at Rheinmetall.

|

Fig. 4-5: Water management as a resource problem |

Rheinmetall last published its own sustainability report in 2017 under the title „Values, Change, Growth“. 15https://www.rheinmetall.com/media/editor_media/rheinmetallag/csr/csr_bericht/Rheinmetall_Nachhaltigkeitsbericht_2017.pdf It includes examples of energy efficiency projects that have led to significant savings in heating oil, water and electricity. More recent sustainability presentations by Rheinmetall are included in the annual ESG reports.

The KNDS Group, which includes Kraus-Maffei Wegmann, has no Group reports on its website.

At Airbus, the most important defence company in Germany and the EU through its subsidiary „Airbus Defence and Space“, there are many statements under the headings „Sustainability“ and „Environment“, but these are limited to declarations of intent to achieve climate neutrality. Technological solutions presented by Airbus Defence and Space in the „Carbon Reduction Plan“ refer to efforts to improve energy efficiency in industrial production.16https://www.airbus.com/sites/g/files/jlcbta136/files/2022-04/Airbus%20Defence%20and%20Space%20Ltd%20Carbon%20Reduction%20Plan.pdf

The parent company’s issue on GHG emissions from aviation is presented as a statement of intent for a completely unrealistic switch to eFuels from „green“ hydrogen. (See also chapter 5.6).

An international comparison of CEOBS17https://ceobs.org/environmental-csr-reporting-by-the-arms-industry/ carried out in 2021 showed that relatively good approaches are discernible overall, at least in the listing of energy consumption and associated GHG emissions, as well as in water and waste management, insofar as these resources are treated with absolute figures. The mere reference to percentage savings in production processes, on the other hand, has little significance.

Sector-specific issues such as the effects of emissions at high altitudes and in outer space are hardly addressed. Similarly, environmental issues related to raw materials in supply chains are not mentioned.

In general, the lack of a uniform reporting framework for energy, water and waste makes comparison between defence companies difficult.

Competition between industrial sectors

Armament resources are in direct competition with the requirements of a resource strategy oriented towards sustainability. This must take into account that an increasing demand for scarce materials for the transformation of energy production can only be met if the demand for armament production is not massively increased at the same time.

On the contrary, it is necessary to take into account the limited availability of mineral as well as metallic resources for military strategies as well as for the civilian economy and, for example, to give preference to „resource-light“ defence strategies with a comparable level of security.

This would also prevent the defence industry’s contribution to global CO2 emissions from rising from 2% today to 25% in 2050, unless special efforts were made here as planned in civilian sectors.18See from already mentioned source: Boston Consulting Group

Transparency about resource consumption

According to UBA recommendations, major material flows and energy consumption should be reported in a standardised form in corporate sustainability reports. Although there are good international approaches, there is still a lot of room for improvement in the presentation of sustainability in the defence industry.

However, the focus should be on concrete information, especially the naming of the absolute quantities of critical and strategic resources consumed. The mere naming of relative savings in technical processes has little relevance if at the same time there is an increase in production figures.

Only such increased transparency, which includes publicly accessible reporting by the Bundeswehr on the resources it consumes, will enable the Bundeswehr to be included in the implementation of the climate neutrality and resource consumption reduction targets enshrined in the coalition agreement. So far, such a reporting system is rudimentary at best.

References

Authors‘ collective EU-JRC. 2020

Critical Raw Materials for Strategic Technologies and Sectors in the EU – A Foresight Study

https://rmis.jrc.ec.europa.eu/uploads/CRMs_for_Strategic_Technologies_and_Sectors_in_the_EU_2020.pdf

Selwyn, Daniel. 2020

Martial Mining | Hrsg.: London Mining Network

https://londonminingnetwork.org/wp-content/uploads/2020/04/Martial-Mining.pdf